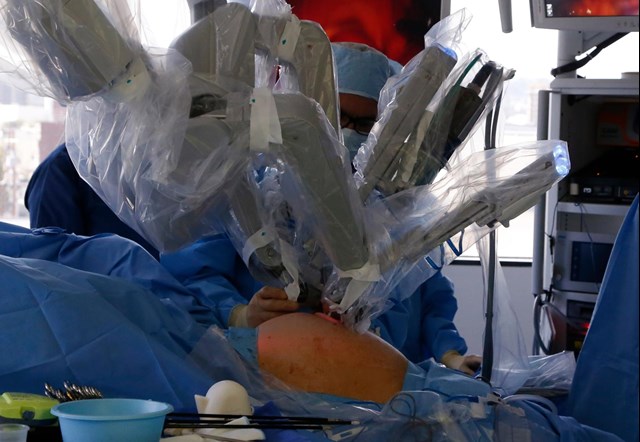

A robotic-assisted hysterectomy performed in 2014 at miVIP Surgery Center, in Los Angeles, California.

Pharmaceutical and consumer-goods company Johnson & Johnson (J&J) sees a lot of robotic surgery in its future. “We’re taking an outlook that digital surgery will be an important dynamic for the next five, 10 and 15 years,” chairman Alex Gorsky said during the company’s fourth-quarter earnings call on Jan. 22. The same day, Bloomberg reported that J&J is looking to buy $2 billion medical robotics company Auris Health, which would add to its already-sizable robotics surgery investment; in 2015, for example, J&J partnered with Alphabet’s Verily Life Sciences to create the startup Verb Surgical, focused on robotic-assisted tools for surgeons.

J&J isn’t the only company focusing on robotic surgery: Irish healthcare company Medtronic recently bought Mazor Robotics, which creates robotics assistance tools for spine and brain surgery, for $1.7 billion, while plenty of smaller companies that work on robotic surgery devices are growing as investment ramps up.

Robotic surgery is currently always used to assist a human surgeon—in other words, no robot is performing surgeries on its own—and, to date, most robotic surgery is in urology or gynecology, where the robot helps access narrow, difficult to access spaces in the human body. But though robotic systems are expensive to acquire and run, meaning they add to the cost of surgery, studies so far suggest they don’t provide better results than non-robotic-assisted surgery.

Herbert Chen, chair of the department of surgery at the University of Alabama-Birmingham, which has one of the largest academic robotic-surgery programs in the US, says the mixed data reflect the human involvement in robotic surgery. Most of the studies haven’t been randomized, controlled trials where a large number of patients have robot-assisted and unassisted surgery from the same surgeons, he says. In other words, the data we have don’t necessarily show the full impact of the robotic tools.

Chen says robotics makes certain operations “much easier” and can increase precision. “If the technology continues to develop, it will play an increasing role in more procedures,” he says. “Most programs are investing in robotics or robotics training because programs do think that’s going to be important for surgeons in the future.”

To Gabriel Barbash, director of the Bench to Bedside Program (which focuses on how lab research can be applied to help patients) at Weizmann Institute of Science in Israel, the only real effect of robotic surgery so far is its impact on surgeons. “Robotics surgery as of today has not contributed enough to the outcome of patients. It has changed a lot in the lifestyle of the surgeons, it made their work more interesting, more gadget-oriented,” he says.

Given that robotics adds several thousand dollars to the cost of surgery, Barbash does not consider it currently worthwhile. “When you look at a national level, this is a huge amount of money,” he says. Barbash notes that US surgery departments are increasingly introducing robotic surgery in a bid to attract surgeons, but European institutions tend to be more cost-aware.

In the future, Barbash expects robotics surgery to become more useful when it is integrated with artificial intelligence. That could, for example, allow the robot to alert surgeons to nuances in the procedure, such as precisely differentiating between malignant and non-malignant tissue during surgery. This will take decades, though, rather than years. “We’ve been talking about it for 10 years and it will take another 10, 20 years because we tend to under-appreciate the complexity of bio-physiological systems,” he says. “It takes a lot of time to incorporate AI in the healthcare field.”

Both Barbash and Chen agree, though, that more companies investing in robotic surgery should ultimately improve the field. Until recently, robotic surgery was dominated by Intuitive Surgical’s da Vinci surgical system, which was approved by the US Food and Drug Administration in 2000. Barbash hopes that ending the monopoly could help reduce the costs of robotic surgery, while Chen says it should improve the technology. Either way, though, this is certainly a long-term investment.